Federal Funding Cuts Claim Its First Public Media Station

Yesterday afternoon, Penn State announced that they'd be shuttering WPSU FM and TV in June of next year.

Eight short weeks ago, Congress passed an expansive rescissions package that cancelled two fiscal years of federal funding for the Corporation for Public Broadcasting. Shortly afterwards, the legislative body quietly declined to include appropriations for CPB in its upcoming budget, officially ending federal funding for public media.

CPB was the first casualty of the end of federal funding, announcing on August 1st that most staff would be let go by the end of September and that the Corporation would cease operations by the end of January. Since then, public media stations across the country (and its territories) have been furiously fundraising and preparing grant applications in response. But none have officially announced their closure - until now.

Yesterday, Penn State University’s board of trustees voted unanimously to reject WHYY’s offer to acquire the broadcast licenses for WPSU FM and TV, a deal that had been nearly two years in the making. Shortly afterwards, WPSU informed its staff that the station would be shuttering by June of next year, making WPSU the first public media station to publicly announce its closure since the rescissions bill passed.

After the jump, I’ll take a quick look at WPSU’s finances and why the university declined WHYY’s offer in the first place.

Two Years in the Red

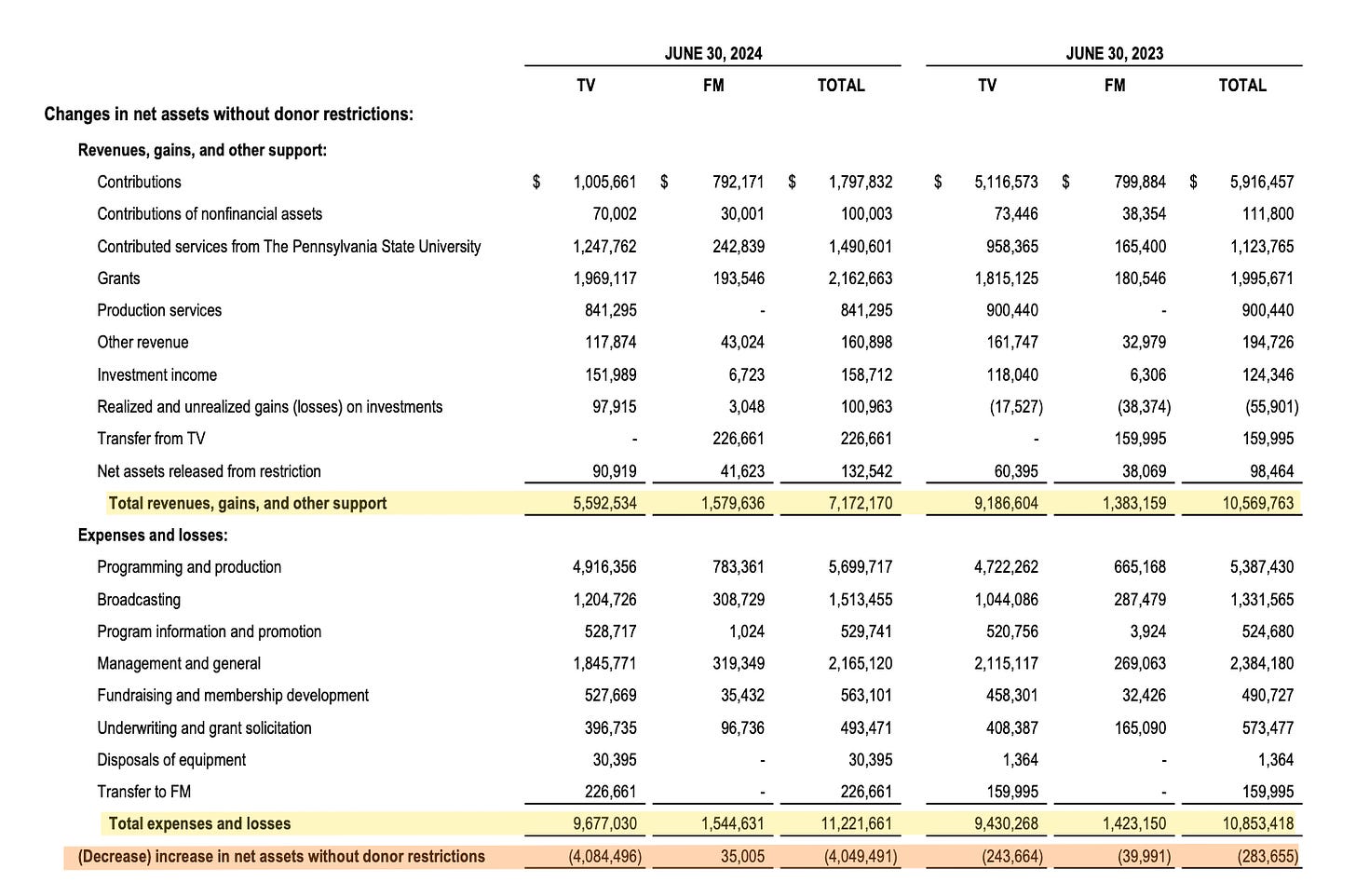

WPSU’s combined yearly financial audit can be found here. For this analysis, we are focused on page 24, the revenues and expenses broken down by TV and radio.

In FY23, which is what my dataset consists of, both broadcast arms of WPSU lost money: $103k for television and $55k for radio. That’s 1% of television’s total revenue and 4% of radio’s. The two stations relied on federal grants for about 18% and 13% of their budgets respectively.

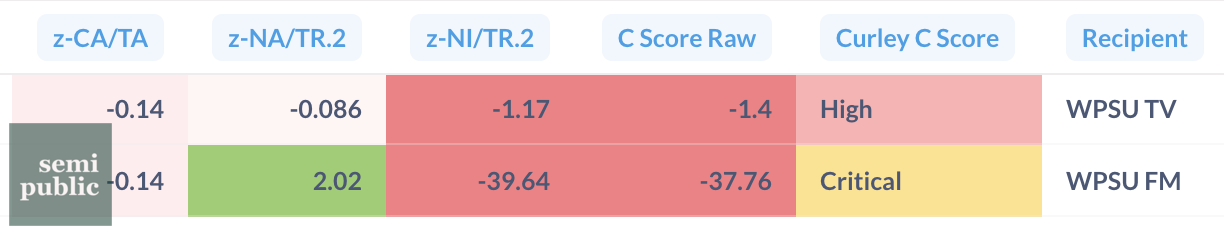

When I subtracted federal funding from WPSU’s revenue and income from FY23 to apply them to my Curley C Score model way back in July, the dangers for both FM and TV were stark.

As a reminder, I created the C Score by choosing three ratios - current assets over total assets (CA/TA), net assets over total revenue (NA/TR), and net income over total revenue (NI/TR) - that I found to be the most predictive of financial stress in public media stations based on reported layoffs. Then, I took the calculated ratios and applied a Z score normalization to them, which subtracts the calculated ratio from the mean of the entire dataset and divides it by the standard deviation. Basically, I calculated how far above or below each calculated ratio was from the average of the rest of the public media stations I had data for.

As you can see in the chart above, WPSU FM’s net income over total revenue was many, many standard deviations (nearly 40) below the average after losing federal funding. Basically, they would have lost more money as a percentage of their revenue than most other stations in FY23 - something that would be difficult to recover from.

WPSU TV, on the other hand, also had a NI/TR below the mean, but only by about one standard deviation. This would certainly put them in financial distress, but it wouldn’t necessarily mean closure.

Now let’s talk about FY24.

Last year, WPSU’s television arm lost a significant amount of money while radio made a small profit: A loss of over $4 million for the former, wiping out a whopping 70+% of their revenue, and a modest gain of $35k for the latter, or about 2% of their revenue. WPSU TV’s federal reliance also jumped to about 30% of their total budget, while FM’s reliance was about 12%.

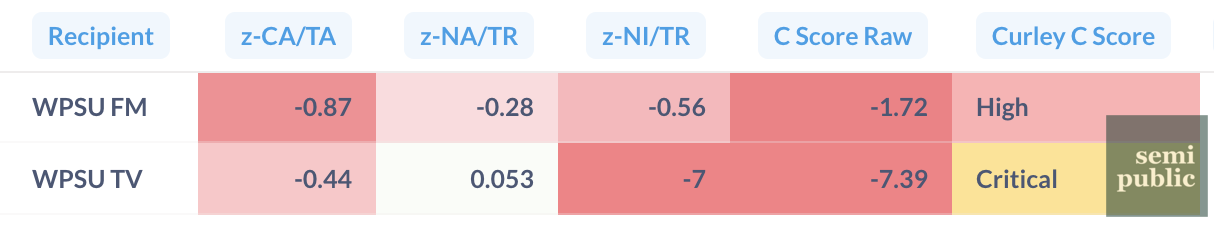

When the Curley C Score is applied to FY24 finances with CPB funding subtracted, WPSU FM and TV flip: The former now has a “high” financial distress score while the latter has a “critical” financial distress score. Again, it’s the very low net income compared to the rest of public media that drags both entities into financial distress, but now so does the relatively low amount of current assets, or assets that can be converted into cash within 12 months.

So what can we take away from WPSU’s finances and C Scores? The first obvious answer is that the broadcaster was already losing too much income and the loss of federal funding exacerbated it. But income losses can be overcome. This leads us to the second answer, which is that WPSU has determined their current assets ($2.9 million, which includes cash) aren’t nearly enough to stem their total losses (around $6 million, which includes CPB funding), even in the short term. It’s hard to see how they could have stayed afloat even with an acquisition by WHYY.

The Incentive Not to Transfer

Here are the terms of the failed transfer deal as described in WHYY’s reporting:

The transfer of all WPSU signals, including 4 radio towers and repeaters and two television transmitter sites.

A 5 year, $17 million subsidy from PSU to WHYY.

No commitment by WHYY to re-hire WPSU’s 44 full-time staff.

Basically, Penn State would be paying WHYY $3.4 million a year on top of losing $10-12 million in federal grant money. Additionally, as one trustee expressed before the vote, “at the end of the day, there’s no guarantee [WPSU will] stay in business,” meaning, presumably, that there was no guarantee from WHYY that they wouldn’t close the station and sell the assets after the transfer anyway. Calculating the value of WPSU’s TV and FM licenses isn’t straightforward, but I would guess they’re worth several million dollars in a private sale - enough for WHYY to recoup some lost federal funding or for Penn State to recoup some of FY24’s losses.

It’s worth keeping in mind that WHYY’s total revenue in 2024 was $54 million while Penn State’s was over $9 billion. This was a risky investment for one party and chump change for the other.

The real tragedies are the “1.5 million Pennsylvanians” (according to WHYY’s CEO) who will lose access to local, independent journalism, as well as the 44 WPSU employees who will lose their jobs after, essentially, being haggled over.

There may be a small chance that Penn State could reconsider - 9 months is a rather long runway considering the circumstances - but, unfortunately, I wouldn’t be surprised to see more stations skip a long, painful road to sustainability in favor of an easy private license sale over the next few months.

If you found value in this post, please consider supporting me with a paid subscription, or by buying me a coffee.