Public Media Jobs Index: August 2025

Stations begin reacting to July's rescissions package.

Last month, I commented on how surprised I was that July’s public media job openings didn’t seem to have been affected by the end of federal funding. It’s obvious to anyone in or around the industry that the passing of the rescissions package led to a great deal of immediate action by stations. As of last night, public media trade journal Current has reported on 14 different layoffs that have happened in the industry since July 18th, and there are certainly several more that, for one reason or another, have instituted layoffs without making it into Current.

Now we know for sure that last month’s resilience was actually the middle of a hiring flatline.

Today’s jobs index post will be brief for two reasons: First is that there’s a lot I’ve been working on this week at Semipublic, both behind the scenes as well as in the public eye. In case you missed it, I made my CPB financial dataset free to the public on Labor Day and made a few promises about keeping CPB data free and accessible, and yesterday morning I announced the launch of two very exciting tools I created in collaboration with Public Media Company that allow stations to benchmark their revenues and expenses against the rest of the public media industry. No paywalls, no data collected, just two tools that stations can use to make fast decisions.

The second reason is simply that August’s jobs data looks very similar to July’s. Not that August wasn’t an important month, but I am quite curious to see how stations will be hiring (or not) during September and October in preparation for a new fiscal year.

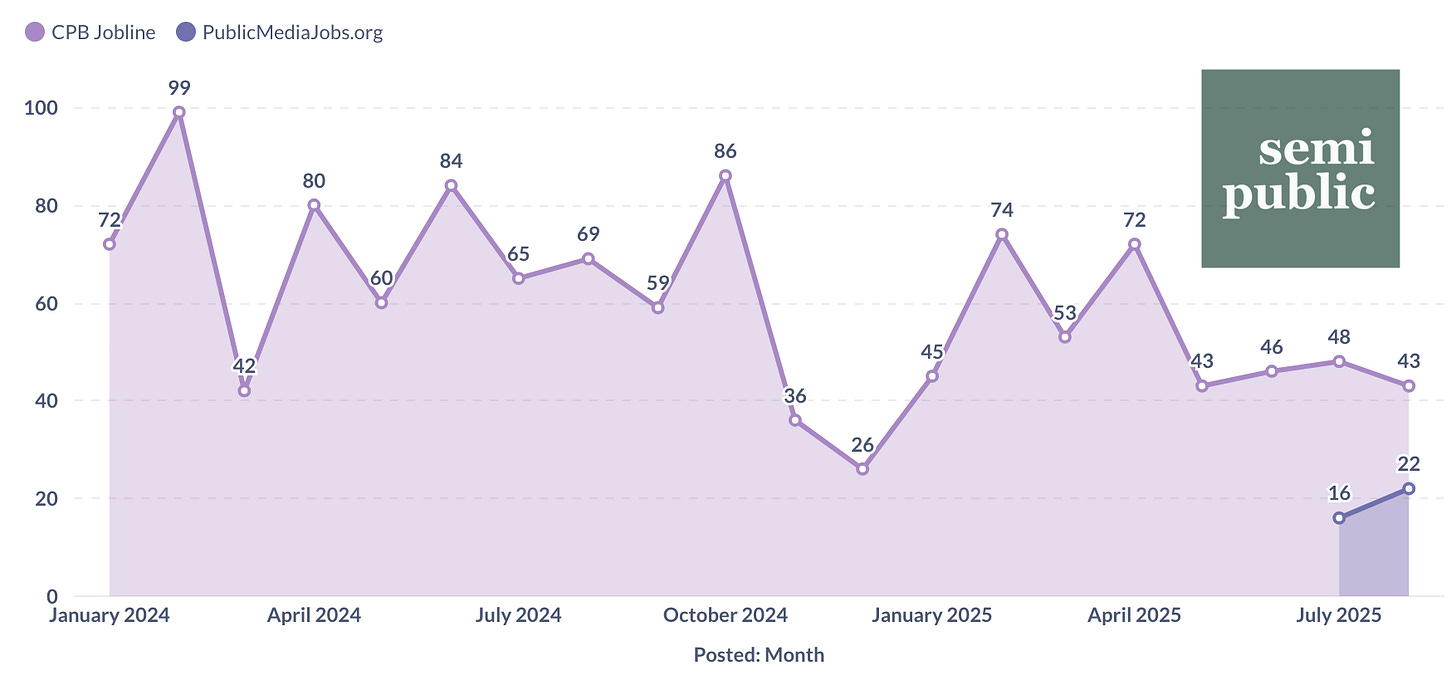

For the month of August, there were 43 total job listings posted on CPB Jobline, a 5-listing drop from July 2025 and a 26-listing drop compared to August 2024. Alternatively, PublicMediaJobs.org, in its first official jobs index appearance, gained 6 listings from July 2025.

When comparing year-to-date for both 2024 and 2025, this year’s public media job listings are down nearly 26% from January to August for both years.

As you can see in the first graph, there is a peculiar flatlining beginning in May that did not resolve as of August 31st. A downside to my dataset is that I could only collect CPB Jobline listings all the way back to January 2024 (and I couldn’t gather any historical data at all for PublicMediaJobs.org) so there’s no real way to know if this string of similar jobs numbers is significant or not.

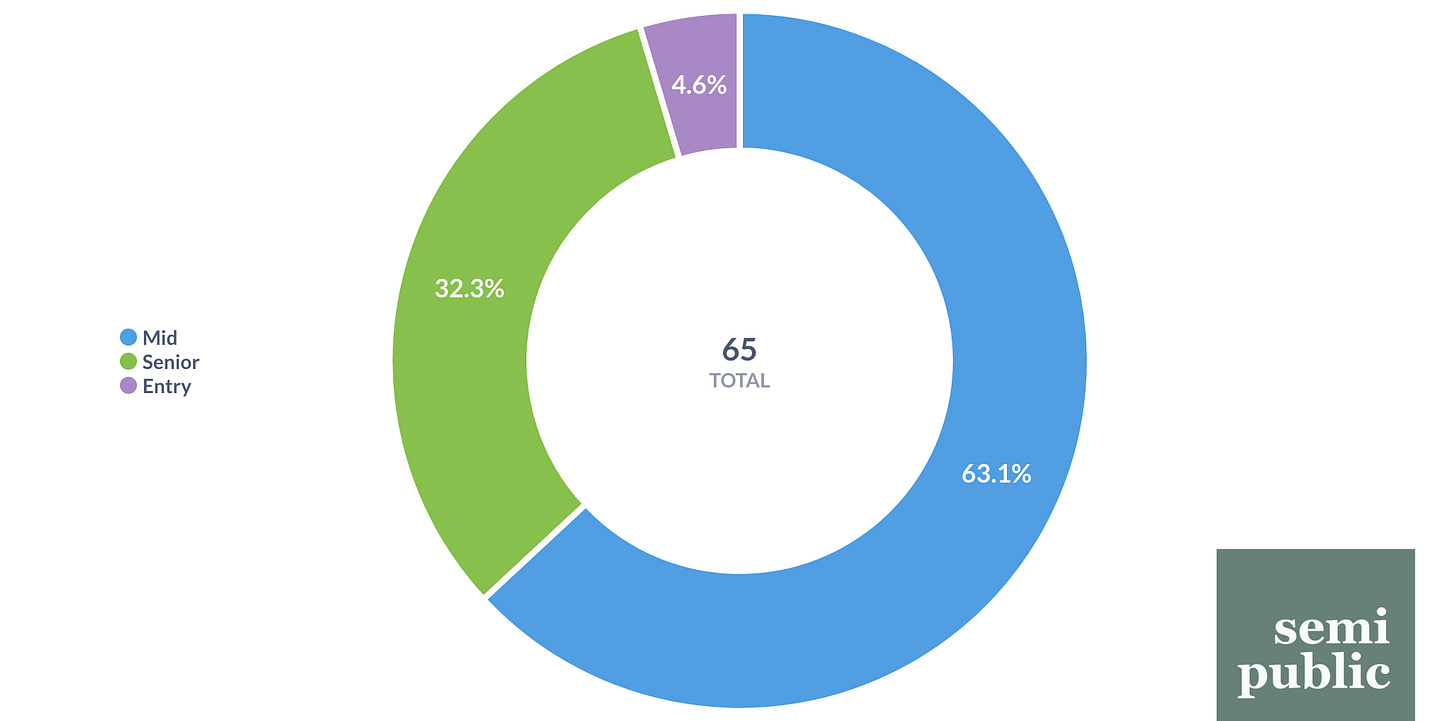

When breaking jobs down by experience level required (I go into detail on how I categorize them in the first jobs index post), you can observe something that I’ve repeated since I started tracking job openings in June: Opportunities for early-career workers are almost non-existent in public media. In fact, they seem to be clustered at the top.

Since June, the share of Senior-level job listings among all tracked listings has been 27%, then 19%, and now a whopping 32%. Again, this dataset is limited from a historical perspective, but the relatively high demand for upper-level managers and leadership does seem significant. Public media has never quite paid as well as other industries, perhaps the prospect of leading a station through a crisis situation while also making even less money is pushing experienced, Senior-level employees out.

All in all, August’s public media jobs numbers show what has been a grim summer, and possibly portend a worse fall. But public media isn’t alone, nearly every industry in the U.S. is experiencing the same kind of flatlining. I’ll be very interested to see what hiring moves public media makes when stations don’t receive a check from CPB for the first time in almost 5 decades.

September and October, I think, will be bellwethers for the rest of the next fiscal year - not just in terms of hiring, but also in terms of station survival.

As always, here’s an interactive dashboard of some of the metrics discussed in this newsletter. If you enjoyed this post, please consider supporting me with a paid subscription, or by buying me a coffee.